As organizations build their budgets for next year’s meetings, they shouldn’t expect any relief from the increasing cost of airfares, hotels, and other services, according to the recently released 2024 Global Business Travel Forecast from CWT and the Global Business Travel Association. However, there is some good news from the report: Price rises are likely to moderate.

One example is an expected slowdown in airfare increases. After an eye-watering 72 percent jump in the average ticket price in 2022, average round-trip ticket prices are expected to finish 2023 just 2.3 percent higher than 2022 at $766. And in 2024, the forecast is for round-trip fares to rise 1.8 percent to an average of $780.

That’s the global average, though; the comprehensive CWT/GBTA report also drills down geographically and by price category. For instance, average economy-class tickets in the North America region are lower than global average fares, but still forecasted to rise:

2019: $442

2020: $391

2021: $338

2022: $523

2023: $532

2024: $545

The price of hotel rooms will also continue to climb, and at a somewhat faster rate than airfares. The CWT/GBTA report sees a 4.3 percent year-over-year increase in the global average daily rate to $168 this year, followed by a 3.6 percent increase in 2024 to $174. Drilling down on just the upscale hotel sector in North America, ADR is expected to come in at $239 for 2023 and rise 3.3 percent to $247 next year.

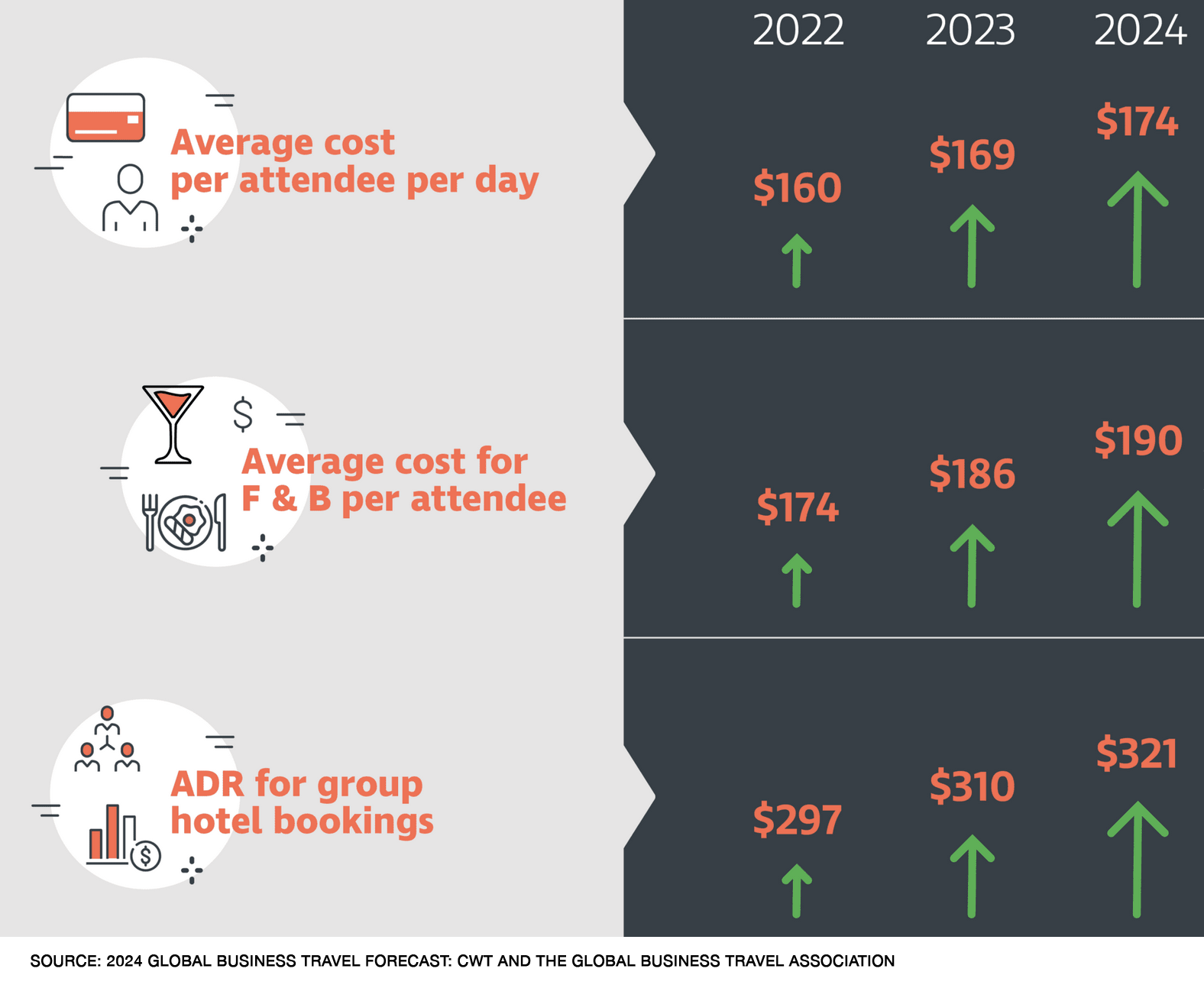

But those average rates are not the same as average group rates. The CWT/GBTA forecast says the ADR for group hotel bookings will rise from $297 in 2022 to $321 in 2024, with food-and-beverage costs seeing a similar jump:

While demand for meetings and events “had rebounded sharply,” the report notes that meeting buyers are still expecting pre-pandemic pricing. “Many [host organizations] have not fully adjusted their mindset budget-wise, as many buyers still anticipate a return to 2019 pricing. The whole travel supply chain, which feeds into meetings and events, has raised prices significantly. Availability is also constricted, which affects pricing. Right now, buyers cannot have preconceived ideas about how far their budget will go.”

The full 2024 Global Business Travel Forecast is available here.

The Continuing Need to Travel

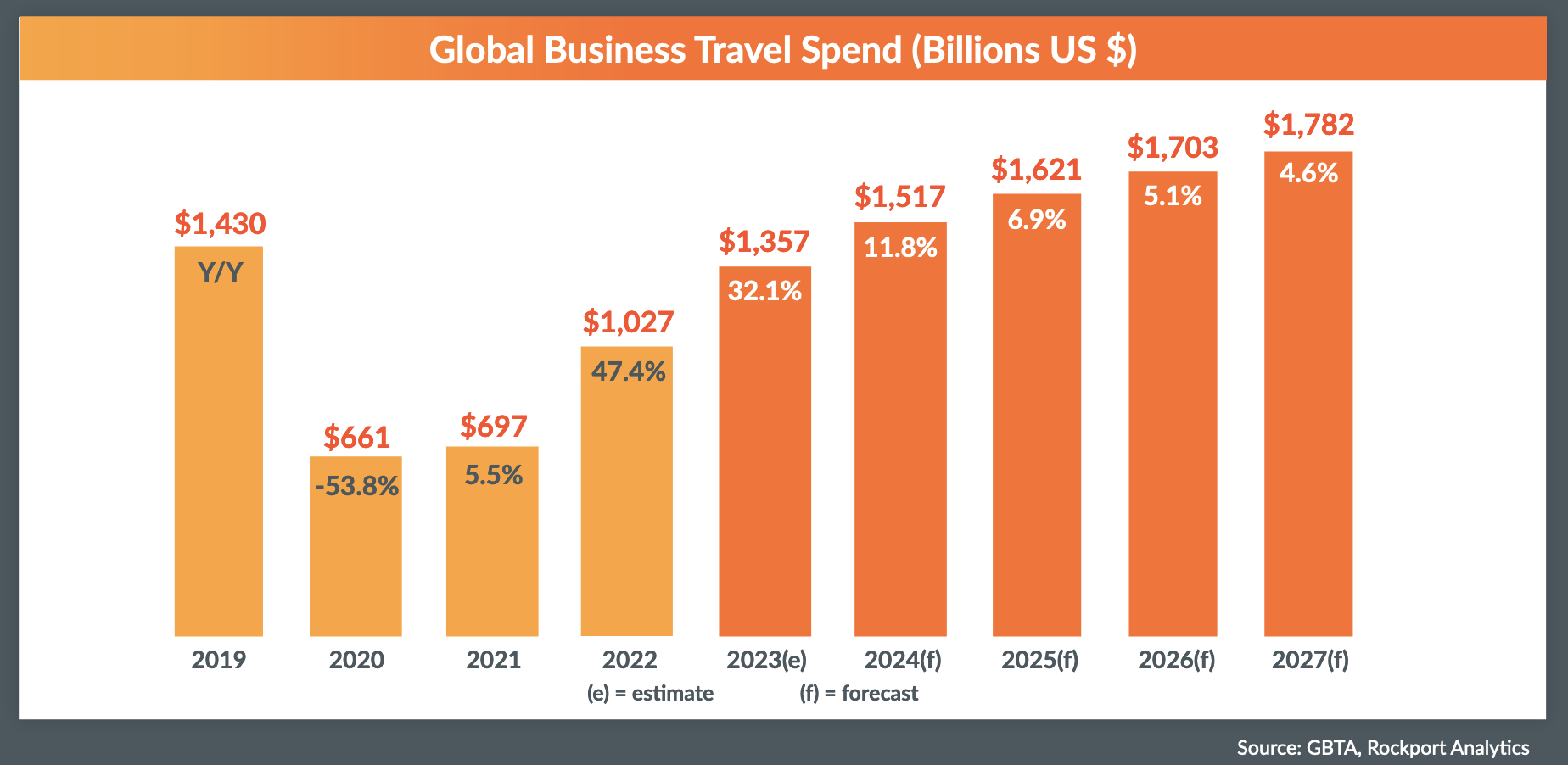

While the cost of business travel and business meetings continues to rise, corporate travel spending is expected to follow a similar curve, according to a separate survey from GBTA.

The 2023 Business Travel Index Outlook, released August 14 at the GBTA Annual Conference, reports that global spending on business travel jumped 47 percent in 2022, finishing the year at $1.03 trillion.

At this rate, travel spending is expected to rebound to its pre-pandemic total of $1.4 trillion in 2024. That’s impressive considering that just last year the BTI Outlook projected that business travel would hit pre-pandemic levels in mid-2026.

The report notes that the most important factor driving global business travel’s recovery is the progress made fighting the Covid-19 pandemic. However, a major contributor to the accelerated timeline of the recovery is the stability in the global economy, where projected recessions have not materialized. Additionally, two factors that have stabilized the business-travel market over the last six months are the return of in-person meetings and events, and the recovery of some international business travel.